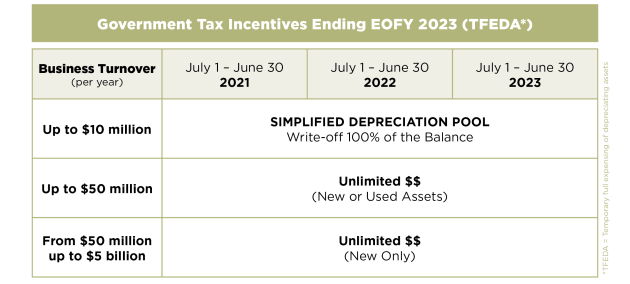

The government's Instant Asset Write Off is set to finish on 30 June, with eligibility conditional on the asset installed or first used by that date, not just ordered by then, as Finlease advises.

Brought in by the Morrison government in the October 2020 budget as Covid was wreaking havoc with the economy, the popular measure enables businesses to deduct the full cost of eligible capital assets acquired from 6 October 2020 (Budget night) and first used or installed by 30 June this year.

Full expensing in the year of first use will apply to new depreciable assets, and the cost of improvements to existing eligible assets. For SMEs (companies with turnover less than $50 million per annum), full expensing also applies to second-hand assets.

Small businesses (turnover less than $10 million per annum) have been able to deduct the balance of their simplified depreciation pool at the end of 2021, 2022 and/or 2023. The provisions which prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out, will continue to be suspended.

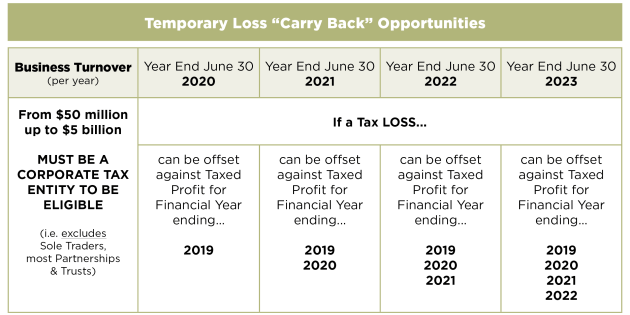

Table 2 below is a simple table and summary of the Loss Carry Back opportunities, as announced in the federal government’s 2020 Budget.

The government will allow eligible companies to carry back tax losses from the 2019-20, 2020- 21, 2021-22 or 2022-23 income years to offset previously taxed profits in years later than 2018-19.

Corporate tax entities with turnover less than $5 billion per annum can apply tax losses against taxed profits in a previous year, generating a refundable tax offset in the year in which the loss is made. The tax refund would be limited, by requiring that the amount carried back is not more than the earlier taxed profits, and that the carry back does not generate a franking account deficit.

The tax refund will be available on election by eligible businesses when they lodge their tax returns for 2020-21, 2021-22 and 2022-23 income years.

Currently, companies are required to carry losses forward to offset profits in future years. Companies that do not elect to carry back losses under this measure can still carry losses forward as normal.

To simplify and provide clarity, a conversation with your finance broker and accountant could benefit those making capital purchases in the near future.

If you are looking to purchase new gear, Finlease highly encourages businesses to chat to their finance brokers and accountants on how to best take advantage of the government tax incentives. With these ending in just over two months time, there’s potential for businesses to see significant savings with some strategic planning.

Finlease is a sponsor of the Australian Packaging & Processing Machinery Association.