[SPONSORED CONTENT] The Australian Packaging Covenant Organisation’s (APCO) 2030 Strategic Plan mentioned eco-modulation, a concept many people are unfamiliar with. Phantm's Francesca Puleio explains what this means and why it is important.

What is eco-modulation?

Eco-modulation is a framework for measuring and assessing packaging materials placed on market (POM) based on their environmental impact. This framework is then used to determine fees for the packaging itself.

In simple terms, the packaging choices you make will directly influence the fees you pay. Here’s how it works:

- producers pay a material fee based on what they place on market – e.g. plastic, cardboard and glass; and

- discounts and costs are then applied depending on the packaging’s recyclability features and environmental impact.

If you adopt design principles that make your packaging easier to recycle and minimise environmental damage, you pay less – a bonus! On the other hand, if it is difficult to recycle or has a high environmental impact, you face a higher cost.

From FY27, APCO will introduce this fee structure for members that have an annual turnover greater than $5 million, with the aim of driving more sustainable packaging placed on market.

Does eco-modulation really work?

Packaging waste is not a simple problem. Not all materials are created equal, and the overall environmental impact of a product depends on different factors like colour, size, and recycled content.

For example, while a clear plastic bottle may seem more recyclable than a coloured one, factors like its size or label can drastically change the cost of recycling. This is why material fees alone can create a black-and-white perspective, and where eco-modulation introduces nuance, rewarding producers for better design choices that lead to less waste.

In countries like the Netherlands and Belgium, which have been early adopters of eco-modulation, recycling rates have increased, reaching as high as 88 per cent and 80 per cent respectively. Fees are determined by waste management companies that channel the funds into improving their recycling infrastructure, ensuring the system becomes more efficient over time.

But there’s a catch – experience tells us that low fees will fail to disrupt the packaging landscape and drive meaningful change. For eco-modulation to have real impact, the initial fees must be high enough to shake things up and accelerate progress.

What are the constraints?

One of the biggest challenges when implementing eco-modulation is striking a balance between complexity and simplicity. Fee structures are usually either overly complicated or too generalised, with neither having meaningful impact.

For example, France has a highly tailored system that applies discounts and costs to the design features of a product. While this framework accurately reflects the product’s environmental impact, it requires rigorous reporting from producers, adding a heavy administrative burden.

On the other hand, the UK fee structure groups all plastics together, failing to differentiate between materials like rigid and flexible plastics, or coloured and clear varieties. These features impact the recyclability of this material, and this oversimplification discourages meaningful progress towards improved recycling.

The advantage of starting with a simple system is that it can be improved over time as complexity is introduced; it is easier to make it harder in the future.

Can it work in Australia?

APCO has stated that the fees generated from eco-modulation will go back to APCO, which will then decide how it is spent. So far, APCO has outlined its commitment to support partnerships with waste management services and implement a consumer education campaign.

This approach contrasts systems in Europe, where eco-modulation fees are distributed to waste management services to improve collection and recycling infrastructure, thereby directly contributing to improving recycling rates.

For eco-modulation to succeed in Australia, APCO must ensure that the fees collected from packaging producers are reinvested into improving recycling systems and infrastructure.

According to APCO, Australia’s packaging recycling rate currently sits at 56 per cent, far behind the success stories of the Netherlands and Belgium (more than eighty per cent), where eco-modulation fees are used to improve the collection and recycling of packaging waste.

As well as focusing on recyclability, APCO will need to consider how design principles for reduction, reuse, and refill will be championed under this system. For example, France, which implemented eco-modulation in 2010, awards producers an eight per cent reduction in fees for packaging that uses less material or supports refill systems. France’s framework supports the ultimate goal of less packaging being placed on market.

Over time, if APCO’s eco-modulation framework has a significant impact on the packaging industry, fees could eventually be lowered. As more producers make the switch to sustainably designed packaging, the system becomes self-sufficient and requires less funding.

Let’s talk numbers

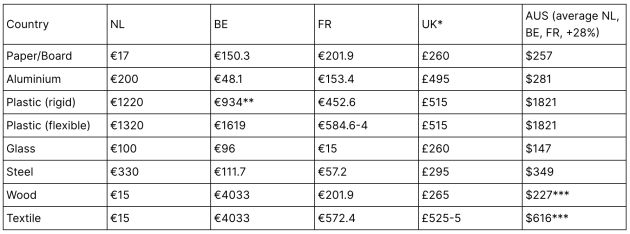

APCO referenced existing frameworks in the Netherlands, Belgium, and France in their approach to eco-modulation. Here’s a glimpse at how fees stack up across these countries:

Eco-modulation fees (per tonne of material)

** Average value. Belgium has an advanced system for plastic categorisation.

*** Excluding BE fee.

(Source: Phantm)

Netherlands/Belgium are 88/80%. Average = 84%, 28% higher than Aus; and

Average Weighted Fee = Fee Average (NL, BE, FR) + 28%.

(Source: Phantm)

These fees take into consideration the environmental impact of each material, how easily it can be recycled, and the infrastructure each country has in place to support recycling.

Discounts are applied for things like material colour and post-consumer recycled content. These can reduce a producer’s fee by up to €100/tonne of packaging placed on market.

Other features, such as loss of material and the quality of recycled material, can see producer fees increase by up to 100 per cent.

In the Netherlands, Belgium, and France, lower eco-modulation fees reflect the high recycling rates and well-resourced recycling infrastructure. In the UK, where fees will be brought in in 2025, extended producer responsibility (EPR) fees are expected to raise £1 billion, which will be used to support local collection and recycling systems.

Final thoughts

Australia sits among the top producers of waste per capita in the world. APCO stated that in 2022, 6.98 million tonnes of packaging was placed on market and 3.07 million tonnes ended up in landfill. Of that packaging, 1.3 million tonnes was plastic, 3.6 million tonnes was paper/board, and 1.1 million tonnes was glass.

Applying our average fees to these waste values amounts to $3.8 billion, a sum that could have a real, long-lasting impact on Australia’s waste management infrastructure.

For eco-modulation to drive much needed change in Australia, APCO’s fees need to reflect the scale of the problem. Our recycling rates trail behind leading countries in Europe and are increasing too slowly to catch up to our growing waste problem.

Our waste production has grown alongside our population. For this reason, discounts on improved recyclability should be minimal to begin with; these changes are meaningless if we can’t provide the resources to improve recycling infrastructure. We must catch up with the problem before we can solve it.

In the end, the greatest impact will come from placing less packaging on market, and APCO should prioritise reduction to achieve a sustainable future for Australia. It is critical that APCO has a transparent and clear plan for allocating fees. Ultimately, it will be consumers, many of whom are calling for change, who will shoulder the burden of increased material fees at the end of the supply chain.

Download Phantm's FREE Extended Producer Responsibility Checklist here.

Phantm is building technology to help businesses capture and consolidate their packaging materials data, make better material choices, reduce costs and minimise exposure to business risk. Book a call to find out how Phantm can help your business get regulation ready.